Types of Crypto Wallets: Which One Is Right for You?

In the evolving world of cryptocurrency, securing your digital assets is of utmost importance. Whether you’re just starting your journey into crypto or you’re a seasoned investor, choosing the right crypto wallet can make all the difference in safeguarding your investments. But with so many types of crypto wallets available, how do you know which one suits your needs? This guide explores the different types of wallets, their pros and cons, and helps you determine the best one for your unique situation.

1. What Is a Crypto Wallet?

Before diving into the various types, it’s crucial to understand what a crypto wallet actually is. Unlike traditional wallets that store physical cash, crypto wallets don’t store your actual cryptocurrency. Instead, they store private keys—the secure passwords that give you access to your digital assets. With these keys, you can send, receive, and monitor your crypto balances. The security of your keys directly impacts the safety of your cryptocurrency, which is why choosing the right wallet is so important.

Table of Contents

2. Types of Crypto Wallets: An Overview

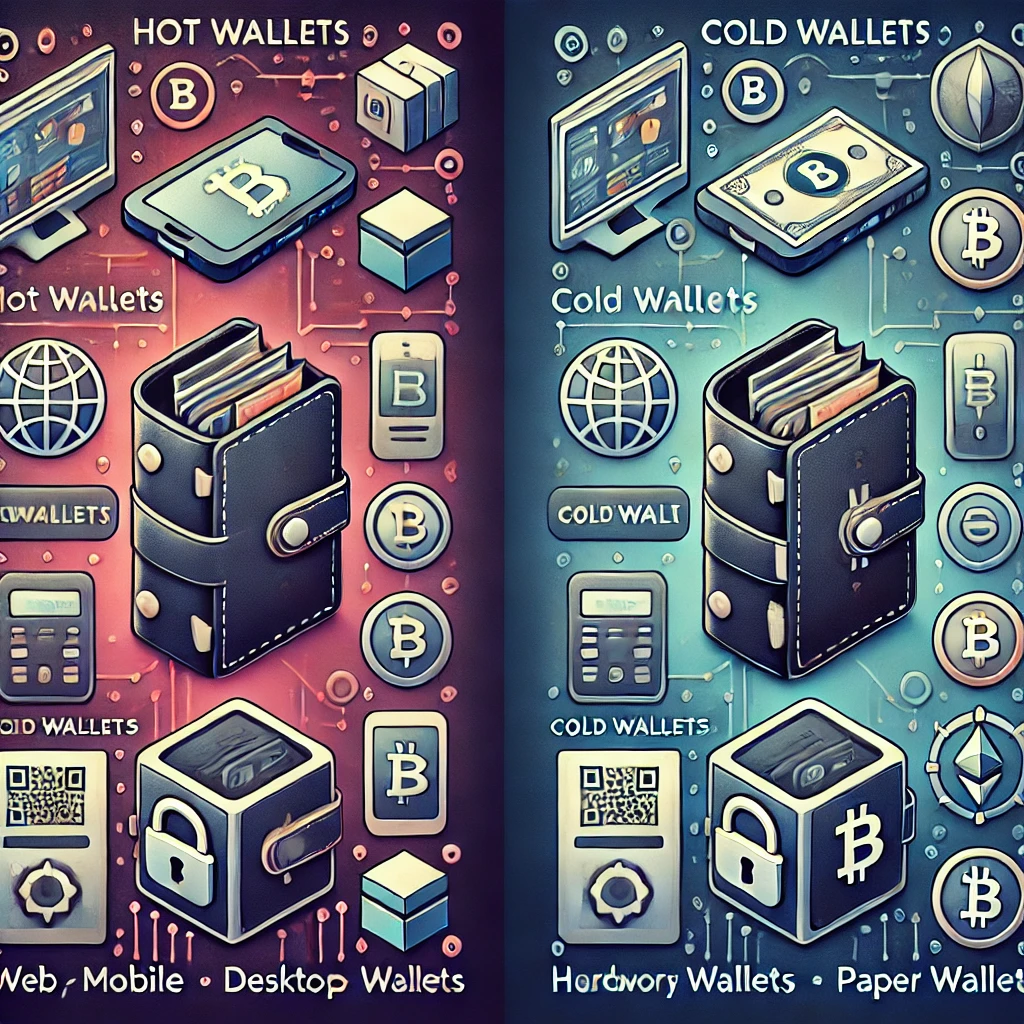

Crypto wallets can be broadly divided into two categories: hot wallets and cold wallets. Each has distinct features that cater to different user needs.

- Hot wallets are connected to the internet, making them accessible but also more vulnerable to hacks.

- Cold wallets, on the other hand, are offline and provide enhanced security, though they may be less convenient for frequent transactions.

Now, let’s dive into the most popular types of wallets in both categories.

3. Hot Wallets: Convenient but Risky

Hot wallets are designed for ease of use and quick access to your funds. If you regularly trade or spend your cryptocurrency, a hot wallet may be the best option for you. However, since these wallets are online, they are more susceptible to security breaches.

3.1. Web Wallets

Web wallets are accessible through a browser, and all you need is an internet connection to manage your crypto. They’re extremely convenient for users who want to trade frequently, but that convenience comes at a cost. Storing your private keys online leaves you exposed to phishing attacks and hacking attempts.

Pros:

- Easy access from anywhere

- No need to install software

- Ideal for beginners

Cons:

- High risk of hacking

- Private keys stored online

3.2. Mobile Wallets

Mobile wallets are apps you download on your smartphone. These wallets allow you to make quick transactions, pay at retail stores that accept crypto, or check your balance on the go. Mobile wallets often have security features like fingerprint authentication or PIN codes, but since your phone could be lost or hacked, there’s still a risk.

Pros:

- Convenient for daily transactions

- Secure with mobile-specific features

- Supports various cryptocurrencies

Cons:

- Vulnerable to malware and hacking

- Losing your phone can lead to losing access

3.3. Desktop Wallets

Desktop wallets are software applications installed on your computer. These wallets give you more control and security than web or mobile wallets. However, they are still considered hot wallets since your computer is typically connected to the internet. Desktop wallets are popular among users who want to store crypto securely on their PCs without relying on web-based services.

Pros:

- Better security than web wallets

- Offers full control over your private keys

- Suitable for long-term storage

Cons:

- Vulnerable to computer viruses and hacking

- Requires backups in case of computer failure

4. Cold Wallets: Maximum Security

For those prioritizing security over convenience, cold wallets are the ideal choice. Since these wallets are not connected to the internet, they’re virtually immune to hacking attempts. Cold storage is perfect for long-term investors or those holding large sums of cryptocurrency.

4.1. Hardware Wallets

Hardware wallets are physical devices that store your private keys offline. These devices typically look like USB sticks and are considered one of the most secure options for holding crypto. Since they are not constantly connected to the internet, they significantly reduce the risk of being hacked. However, they do require a higher level of understanding to operate compared to hot wallets.

Pros:

- Extremely secure and immune to online hacks

- Can store large amounts of cryptocurrency

- Supports multiple types of cryptocurrencies

Cons:

- Expensive compared to other wallet types

- Less convenient for everyday use

- Loss of the device can result in permanent loss of funds

4.2. Paper Wallets

Paper wallets are the most basic form of cold storage. A paper wallet is simply a piece of paper that has your public and private keys printed on it. Since it’s entirely offline, a paper wallet is impervious to hacking. However, it’s also highly susceptible to physical damage or loss.

Pros:

- Immune to hacking

- No need for software or hardware

- Extremely low-cost

Cons:

- Easily damaged or lost

- Complicated for beginners

- Difficult to transfer funds without exposing your keys

5. Custodial vs. Non-Custodial Wallets

Another important distinction when choosing between types of crypto wallets is whether the wallet is custodial or non-custodial.

- Custodial wallets are managed by third-party services (such as exchanges), which means the service holds your private keys for you. This setup is convenient, especially for beginners, but you must trust that the custodian won’t mismanage or lose your funds.

- Non-custodial wallets give you complete control of your private keys. While this means you are responsible for your security, it also provides greater autonomy and less reliance on external services.

6. Multi-Signature Wallets

Multi-signature wallets (or multisig wallets) require multiple private keys to authorize a transaction, adding an extra layer of security. These wallets are ideal for businesses or groups who want to manage crypto collectively. For example, a company could set up a wallet that requires two out of three partners to approve any transaction.

Pros:

- Enhanced security for large or shared accounts

- Reduces the risk of a single point of failure

Cons:

- More complex to set up and manage

- Not ideal for individuals

7. How to Choose the Right Crypto Wallet

Selecting the right crypto wallet depends on several factors, including how often you plan to use your crypto, how much you’re storing, and your comfort level with technology. Ask yourself these questions:

- Do I need quick and easy access to my crypto?

- Am I holding large sums that require maximum security?

- Do I want control over my private keys or prefer the convenience of a custodial wallet?

If you’re a frequent trader, a hot wallet like a web or mobile wallet might suit you best. However, if you’re planning to hold onto your assets for the long haul, a cold wallet—especially a hardware wallet—will provide better security.

8. Security Best Practices for Crypto Wallets

Regardless of which type of crypto wallet you choose, there are certain security measures you should always follow:

- Backup your wallet: Ensure you have a backup of your wallet, especially for non-custodial wallets. Store your backup securely and away from prying eyes.

- Use strong passwords: If your wallet allows for password protection, make sure you use a strong, unique password.

- Enable two-factor authentication (2FA): Many wallets support 2FA for an additional layer of security.

- Beware of phishing attacks: Never share your private keys or seed phrase with anyone. Be cautious of any suspicious emails or websites that ask for this information.

9. Common Mistakes to Avoid

When dealing with cryptocurrency, there are several common mistakes to be aware of:

- Storing large amounts in hot wallets: Always use a cold wallet for significant holdings.

- Not backing up your wallet: Without a backup, losing access to your wallet could mean losing your crypto forever.

- Using untrusted wallets: Only download wallets from reputable sources to avoid scams or hacks.

10. Future of Crypto Wallets

The world of cryptocurrency is continually evolving, and so are the wallets we use. Decentralized finance (DeFi) platforms and new technologies like smart contracts are already shaping the future of how wallets will function. As these technologies advance, we may see more user-friendly, highly secure wallets that integrate seamlessly with the broader financial ecosystem.

Conclusion

Choosing the right type of crypto wallet is an essential step in managing your digital assets securely. Whether you prefer the convenience of a hot wallet or the security of a cold wallet, there’s a solution out there that fits your needs. Always weigh the pros and cons, consider how you’ll use the wallet, and follow best security practices to protect your investments. As cryptocurrency adoption grows, ensuring your crypto is stored safely and securely will be more important than ever.

By understanding the differences between the types of crypto wallets, you’ll be better equipped to make an informed decision and protect your financial future in the world of digital assets.